The Texas Stock Exchange (TXSE) has filed its Form 1 registration with the U.S. Securities and Exchange Commission, initiating a detailed approval process as it prepares to launch as a national securities exchange by early 2026, backed by $161 million in funding from prominent investors such as BlackRock, Citadel Securities, and Charles Schwab Corp. In January 2025, it has initiated a multi-step process towards becoming a national securities exchange, marking the beginning of a potentially lengthy approval process. The timeline for SEC approval typically involves: A 90-day initial review period following the Form 1 filing; potential additional proceedings lasting up to 180 days if the SEC requires further information; continued collaboration between TXSE and the SEC throughout the phases of an involved approval process.

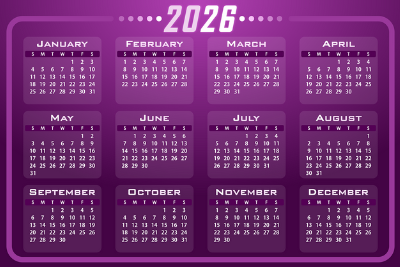

It aims to launch trading operations in early 2026, with listings expected to begin by the end of that year. This timeline reflects its commitment to thorough preparation and regulatory compliance as it seeks to establish itself as a major player in the U.S. capital markets. Operating electronically from Dallas, it aims to revolutionize the U.S. capital markets landscape with a range of innovative features by facilitating trading and listings of corporate issuers, support exchange-traded products (ETPs), even provide auctions and data products. An iconic bell-ringing venue in Dallas, adds a touch of tradition to this modern exchange. The platform is designed to address key challenges, including reducing costs associated with going and staying public, enhancing alignment between issuers and investors, and implementing cutting-edge technology for order matching with a minimal amount of latency.

It has secured substantial financial backing from a diverse group of prominent investors, positioning it as one of the most well-capitalized exchange entrants in history. With a total initial capital raise of $161 million, it attracted support from major financial institutions, liquidity providers, and business leaders. Key backers include: BlackRock and Citadel Securities, two of the world's largest financial institutions; Charles Schwab Corp., the largest retail stock brokerage globally; Other notable investors such as Fortress Investment Group, Jump Trading, Susquehanna Private Equity Investments, and Tower Research. This impressive roster of investors not only provides TXSE with significant financial resources but also lends credibility to its ambitious plans to challenge established exchanges. The diverse mix of backers, representing various sectors of the financial markets, underscores the broad industry support for its vision of creating a more competitive and innovative trading environment.

Notably, it aims to offer a more competitive and efficient trading environment. Its strategic goals include: enhancing the competition around quote activity, liquidity and transparency that ultimately benefits investors, global issuers and liquidity providers alike. It plans to address growing concerns among investors about their increasing compliance costs, as well as stringent new regulations.

Floor Covering Media publishes

blog articles called Flooring Briefs.

Floor Covering Media is

a social media network.

Retrieve timely, objective news and

information at https://www.floorsearch.info.